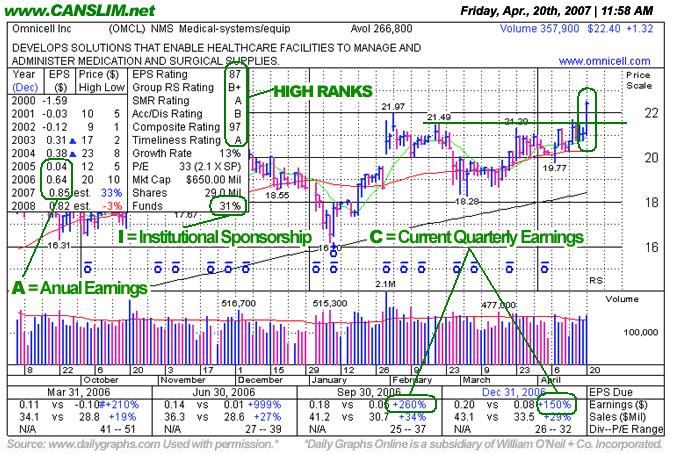

Medical Company Jumps To New Highs!

Friday, April 20, 2007 CANSLIM.net

|

Omnicell Inc. |

|

|

Ticker Symbol: OMCL (NASDAQ) |

Industry Group: Medical - system/equip |

Shares Outstanding: 29,000,000 |

|

Price: $22.06 12:43PM ET |

Day's Volume: 501,900 4/20/2007 12:43PM ET |

Shares in Float: 26,100,000 |

|

52 Week High: $22.54 4/20/2007 12:43PM ET |

50-Day Average Volume: 266,800 |

Up/Down Volume Ratio: 0.9 |

|

Pivot Point: $21.78 4/16/2007 high plus .10 |

Pivot Point +5% = Max Buy Price: $22.87 |

Web Address: http://www.omnicell.com

|

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

CANSLIM.net Profile: Omnicell, Inc. provides various medication control and patient safety solutions for acute care health facilities, enabling them to acquire, manage, dispense, and administer medications and medical-surgical supplies. The company sells its products and services to hospitals and specialty care facilities through direct sales force in the United States and Canada, as well as through distributors in Europe, the Middle East, Asia, and Australia. OMCL has increased its earnings versus the year earlier by an impressive +999% +260%, and +150% in the three most recent comparisons for the quarters ended in Jun, Sept, and Dec '06, with sales revenues up by +27%, +34%, and +29%, respectively. Return on Equity of +26% is higher than the +17% guideline. The company's management owns a 10% stake in its shares, which gives investors a reassurance management is focused on building shareholder value. The company hails from the Medical- systems/equip group which is presently ranked 49th on the 197 Industry Groups list, which places it in the top quartile of industry groups and satisfies the "L" criteria. The number of top-rated funds with an ownership interest increased from 43 funds in March '06 to 70 funds as of December '06, a compelling sign of increasing institutional interest (the "I" criteria).

What to Look For and What to Look Out For: Look for this stock to hold onto its gains and enjoy a new 52-week high close. Now that this issue has vaulted above its pivot point, the path of least resistance is higher and odds favor further price gains. Whenever a stock clears overhead supply or chart resistance, and jumps into new high territory, this typically bodes well for the stock's ability to add to its gains. It is important to note that this stock has encountered resistance several times in the past 12 weeks just shy of $22. That prior resistance level should now act as support. Ideally, in the days immediately ahead OMCL will follow through with additional gains on high volume to confirm the breakout. However, if the stock reverses and trades below support the breakout would be negated, and odds would tip in favor of it spending more time consolidating. The 50-day moving average line is the next important level of technical support, and a violation of the 50 DMA would be a sell signal. If OMCL fails to follow through, the odds of a sustained rise and meaningful gains would be greatly reduced. Always limit losses if any stock you buy closes 7-8% below your purchase price. It would be undisciplined for investors to "chase" this stock and purchase shares above the pivot point by more than+5% , which in this case is the $22.87 "maximum buy" price.

Technical Analysis: The fact that OMCL surged above resistance has bullish implications, as considerable gains on heavy volume are an important component of "accumulation" or institutional buying activity. The stock has risen from an orderly 3 month flat base. The volume dry up during the basing period is one of the healthy aspects of its chart. Volume in the first half of today's session has already reached the necessary total (+50% above average) to trigger a proper technical buy signal.

|

|

About :

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities.

You can contact Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam at kengruneisen@gmail.com

|

|

The information

and writings made

avaialable by individuals that successfully passed the CAN SLIM®

Masters Program are their own. Copyright © 1996-2025

Gruneisen Growth Corp. All rights reserved. Protected by the

copyright laws of the United States and Canada and by international

treaties.

|

|

|

|

|