|

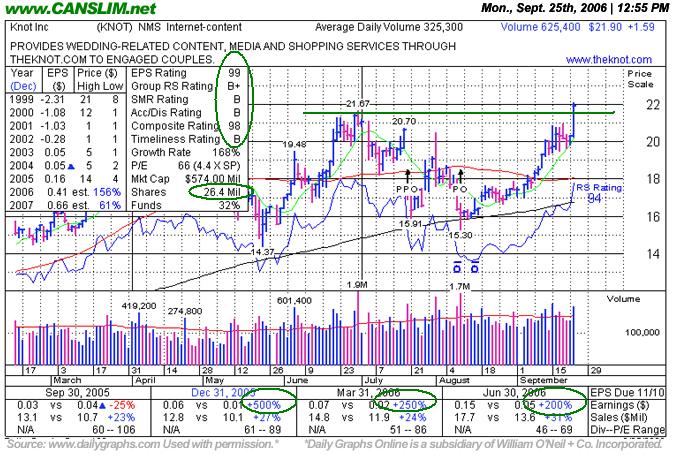

Knot, Inc. |

|

|

Ticker Symbol: KNOT (NASDAQ) |

Industry Group: Internet Information Providers |

Shares Outstanding: 26,380,000 |

|

Price: $21.93 2:30PM ET |

Day's Volume: 1,135,000 9/25/2006 2:30PM ET |

Shares in Float: 13,500,000 |

|

52 Week High: $22.07 9/25/2006 2:30PM ET |

50-Day Average Volume: 325,004 |

Up/Down Volume Ratio: 1.0 |

|

Pivot Point: $21.77 |

Pivot Point +5% = Max Buy Price: $22.86 |

Web Address: http://www.theknot.com |

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

CANSLIM.net Profile: The Knot, Inc operates as a life stage media and services company. The company offers online and offline services to the wedding market in the United States. Its online services include providing ideas, up-to-date information, and resources to assist in the process of planning a wedding through its Web site www.theknot.com. KNOT has increased its earnings by an impressive +500%, +250%, and +200% in the past three quarters Dec '05 and Mar & Jun '06, while during the same time the company managed to increase its sales revenues by +27%, +24%, and +31%. Return on Equity of 12% is slightly lower than the +17% guideline. The company hails from the Internet-Content group which is presently ranked 111th on the 197 Industry Groups list, which unfortunately puts it outside the preferred top quartile of groups. However, the number of top-rated funds with an ownership interest has risen from 16 funds in September '05 to 36 funds as of June '06, a compelling sign of increasing institutional interest (the "I" criteria).

What to Look For and What to Look Out For: KNOT’s ability to breakout to a new 52-week high on above average volume bodes well. Ideally, in the days immediately ahead it would follow through with additional gains on high volume to confirm the fresh breakout. If this stock reverses back below the pivot point by more than 7% it would negate the breakout and then odds would favor it moving lower. It is important to note that prior resistance can often come back and haunt a stock, until it breaks above it. Therefore, if KNOT fails to follow through, the odds of a sustained rise and meaningful gains would be greatly reduced. Always limit losses per the 7-8% sell rule, and never hold a stock if it falls more than that much from your purchase price.

Technical Analysis: Several months ago, KNOT ran into resistance near $21-22, but today's breakout may be signalling the beginning of a meaningful advance. Now that KNOT has taken out its prior chart highs, it has cleared all remaining overhead supply and appears on track for further gains. History shows us that stocks that have cleared prior resistance run the greatest chance of advancing. Keep in mind that the stock has enjoyed a considerable rise from its February '05 breakout, so it may be considered as a late-stage base, thus a strict sell discipline is a must.