A Very Impressive Breakout

Thursday, June 01, 2006 CANSLIM.net

|

NIC Inc |

- Kenneth J. Gruneisen |

|

Ticker Symbol: EGOV (NASDAQ) |

Industry Group: Computer Tech Service |

Shares Outstanding: 61,200,000 |

|

Price: $6.85 4:00PM ET |

Day's Volume: 665,900 |

Shares in Float: 38,000,000 |

|

52 Week High: $6.90 6/1/2006 |

50-Day Average Volume: 169,900 |

Up/Down Volume Ratio: 2.1 |

|

Pivot Point: $6.70 3/21/2006 high plus $0.10 |

Pivot Point +5% = Max Buy Price: $7.03 |

Web Address: http://www.nicusa.com |

C A N S L I M | StockTalk | News | Chart | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

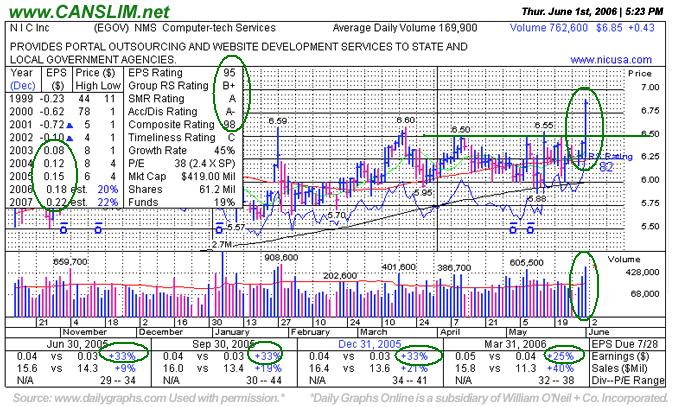

CANSLIM.net Profile: NIC Inc. provides portal outsourcing and related software and services for eGovernment, helping governments use the Internet to reduce costs and provide a higher level of service to businesses and citizens. NIC enters into contracts primarily with state governments, and designs, builds and operates Web-based portals on their behalf. The Company's portals consist of Websites and applications that it builds, which allow businesses and citizens to access government information online and complete transactions, including applying for a permit, retrieving driver's license records or filing a form or report. NIC manages operations for each contractual relationship through separate local subsidiaries that operate as decentralized businesses with a high degree of autonomy. The company has increased its earnings by +33%, +33%, +33% and +25% in the past four quarterly financial reports for Jun, Sep, Dec '05 and Mar '06 respectively. The annual earnings history (the “A”) has shown solid increases in the past three years, a 45% Growth Rate, which helps reassure investors of strength in the underlying fundamentals of the company. Return on Equity of 12% falls a bit under the +17% guideline. Management owns an impressive +38% of the float which helps align their interests with those of their shareholders. The Computer-tech Service group is now ranked 49th of 197 Industry Groups, putting it on the edge of the top quartile, thus confirming there is decent group leadership to fulfill the "L" criteria.

What to Look For and What to Look Out For: Now that EGOV has reached new high territory on above average volume and has decisively passed through its pivot point, odds favor further gains. It is important not to buy any stock extended too far above its pivot point. Investors should always look out for a failed breakout, so if EGOV fails to follow through and rolls back it would give rise to concern. If dropping into its prior base to close under its March 20th, 2006 high close of $6.53, that would technically negate the recent breakout. Then the odds of a sustained rise and meaningful gains would be greatly reduced. Alway limit losses per the 7-8% sell rule, and never hold a stock if it falls more than that much from your purchase price. Another concern is that, even while more meaningful revenue growth has continued on a percentage basis versus the year ago quarters, sequentially speaking, the company's sales revenues have been locked in the $15-16 million range for the past 4 reports. Flatter comparisons in the coming quarters would likely prompt disappointment. Technical Analysis: Today this stock blasted out of a flat base nearly 9-months long, rising on more than four times its average daily turnover. During the previous 9 months there were only 6 weeks of above average volume. It is very positive to see volume gradually dry up when a stock builds out a longer base. This is precisely what occurred, and as a result, it has a solid foundation that may help pave the way for further gains. Study a longer term or weekly graph to see why the next important technical hurdle is all the way up at the stock's January 2004 high of $8.85. However, previous overhead supply more than a year and three quarters old is normally not considered to be a hugely limiting factor as a stock tries to advance. If those important highs are eventually taken out, odds would favor further impressive gains.

|

|

About :

Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam

Kenneth J. Gruneisen started out as a licensed stockbroker in August 1987, a couple of months prior to the historic stock market crash that took the Dow Jones Industrial Average down -22.6% in a single day. He has published daily fact-based fundamental and technical analysis on high-ranked stocks online for two decades. Through FACTBASEDINVESTING.COM, Kenneth provides educational articles, news, market commentary, and other information regarding proven investment systems that work in good times and bad.

Comments contained in the body of this report are technical opinions only and are not necessarily those of Gruneisen Growth Corp. The material herein has been obtained from sources believed to be reliable and accurate, however, its accuracy and completeness cannot be guaranteed. Our firm, employees, and customers may effect transactions, including transactions contrary to any recommendation herein, or have positions in the securities mentioned herein or options with respect thereto. Any recommendation contained in this report may not be suitable for all investors and it is not to be deemed an offer or solicitation on our part with respect to the purchase or sale of any securities.

You can contact Kenneth J. Gruneisen - Passed the CAN SLIM® Master's Exam at kengruneisen@gmail.com

|

|

The information

and writings made

avaialable by individuals that successfully passed the CAN SLIM®

Masters Program are their own. Copyright © 1996-2025

Gruneisen Growth Corp. All rights reserved. Protected by the

copyright laws of the United States and Canada and by international

treaties.

|

|

|

|

|