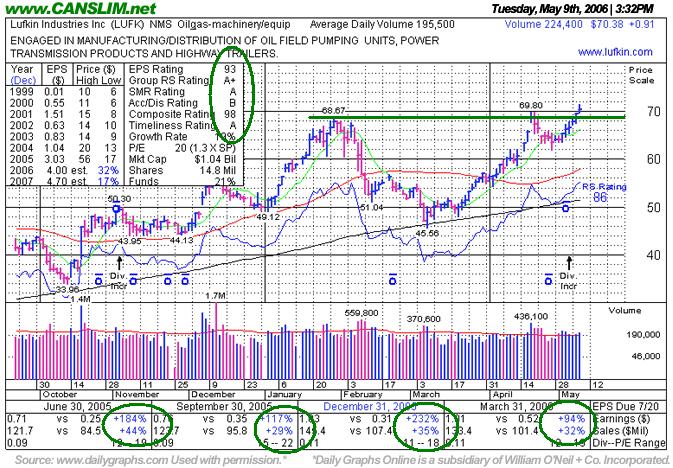

Cup With Handle Set Up

Tuesday, May 09, 2006 CANSLIM.net

|

Lufkin Industries Inc. (LUFK) |

- Kenneth J. Gruneisen |

|

Ticker Symbol: LUFK (NASDAQ) |

Industry Group: Oil & Gas Equipment & Services |

Shares Outstanding: 14,800,000 |

|

Price: $70.90 11:21AM ET |

Day's Volume: 134,100 5/9/2006 11:45 AM ET |

Shares in Float: 13,700,000 |

|

52 Week High: $71.38 5/9/2006 11:45AM ET |

50-Day Average Volume: 195,500 |

Up/Down Volume Ratio: 1.6 |

|

Pivot Point: $69.90 4/19/2006 high plus $0.10 |

Pivot Point +5% = Max Buy Price: $73.40 |

Web Address: http://www.lufkin.com

|

C A N S L I M | StockTalk | News | Chart |  DGO | SEC | Zacks Reports

DGO | SEC | Zacks Reports

View all notes | Alert me of new notes | CANSLIM.net Company Profile

CANSLIM.net Profile: Lufkin Industries, Inc. and its subsidiaries engage in the manufacture and sale of oil field pumping units, power transmission products, and highway trailers worldwide. The company operates in three segments: Oil Field, Power Transmission, and Trailer. The Oil Field segment manufactures and services artificial reciprocating rod lift equipment and related products. It also transports and repairs pumping units, as well as refurbishes used pumping units. In addition, this segment designs, manufactures, installs, and services computer control equipment and analytical services for pumping units; and operates an iron foundry to produce castings for new pumping units. LUFK has achieved stellar quarterly earnings growth and demonstrated annual earnings consistency, thereby meeting the “C” and “A” criteria. Institutional sponsorship has increased from 56 to 89 top-rated funds with an ownership interest from Mar '05 to Dec '05, thus satisfying the “S” and "I" criteria. The company is a high-ranked leader in the Telecom-Wireless Equipment group which presently is ranked 53rd on the 197 industry groups list, hence meeting the “L” criteria.

What to Look For and What to Look Out For: This issue is rising to new highs out of a cup-with-handle type pattern that has formed over the prior 3-month period. Volume in the morning was on track to be an above average volume day, however the guideline is for volume to be at least +50% above average on a buyable breakout. Late afternoon trading today hasn't helped it meet that volume threshold yet. Cup-with-handle breakouts often lead to impressive gains, but most ideally, the volume should be tremendous when a stock triggers a fresh technical buy signal. This stock is currently in new high territory but trading is not intense. Obviously, the whole energy group's direction will certainly be a great factor in the ongoing action. This issue is currently trading above the pivot and below its maximum buy price. Barring some unforeseen event, this selection appears on track to continue moving higher, and it could soon be considered buyable under the guidelines - watch for the volume confirmation. Meanwhile, a retracement toward chart support in the $68-69 range on light volume may present an attractive entry point, which could be helpful if this issue eventually becomes too extended. Conversely, losses leading to a close below its old high closes of chart importance ($68.80 on April 19th, and $67.90 on Januuary 30th) would prompt concern, as deterioration to those levels would negate the technical breakout entirely, leaving the bears in control.

Technical Analysis: This stock surged an impressive +170% from May 2005 to January 2006. After such an impressive run, profit taking led to a deep consolidation where it violated its 50-day moving average and even briefly dropped under chart support near $50 in the range of its July-November '05 highs. It dug its heels in promptly at its 200 DMA and then LUFK spent the first quarter of 2006 building out the rest of a fresh cup-with-handle type pattern.