Raven Industries - November 2005 Stock Bulletin

Tuesday, November 01, 2005 CANSLIM.net

|

Raven IndustriesInc. |

- Frank E. Testa |

|

Ticker Symbol: RAVN |

Industry Group: Diversified Operations |

Shares Outstanding: 18.3 Million |

|

Price: $31.44 (10/31/05 close) |

Day's Volume: 411,000 (10/31/05 close) |

Shares in Float: 281.3 Million |

|

52 Week High: $31.99 |

50-Day Average Volume: 105,800 |

Up/Down Volume Ratio: 1.3 |

|

Pivot Point: $31.07 (9/30/05 high +$0.10) |

Pivot Point +5% = Max Buy Price: $32.62 |

Web Address: http://www.ravenind.com |

C A N S L I M, StockTalk, News, Chart, SEC, Zacks Reports

Profile: Raven Industries, Inc. operates as an industrial manufacturer in North America. The company operates in three divisions: Flow Controls, Engineered Films, and Electronic Systems. Flow Controls division provides electronic and global positioning system products for the precision agriculture, marine navigation, and other markets. It also develops new products for field location control and chemical injection. Engineered Films division produces rugged reinforced plastic sheeting for industrial, construction, manufactured housing, and agriculture applications. Electronic Systems division offers electronics manufacturing services for commercial customers. In addition, the company’s wholly owned subsidiary, Aerostar International, Inc., manufactures military cargo parachutes, government service uniforms, high-altitude research balloons, and other inflatable products. RAVN’s earnings of 2006 are forecasted to rise 33% to $1.29 and an additional 16% in 2007, as Engineered Films should benefit from the recent hurricanes with backlog expected to be at least a year. While costs of resin used in the manufacture of plastic sheeting is closely tied to natural gas and other energy prices, management stockpiled resin pellets at costs ranging from $90K to $105K compared to current resin costs of approximately $115K to $120K per railcar. In addition, capacity constraints should enable the company to pass on price increases from higher resin costs. For its fiscal second quarter of '06, RAVN achieved a 33% rise in net income to $4.8 million, up from $3.6 million in the year ago quarter. Sales rose 22% to $45.3 million. However, revenue growth is expected to be more challenging in the second half of the year because of difficult comparisons versus a year earlier. RAVN’s return on equity (ROE) of 26% eclipses the IBD requirement of at least 17% and its no long-term debt passes the Long-term Debt/Equity criteria of less than 2. Insider ownership of 12% aligns its interests with shareholders, while institutional sponsorship of 50% provides ample opportunity for growth to fuel further gains. Lastly, RAVN hails from Diversified Operations sector, which is currently ranked 45th out of 197 Industry Groups tracked for relative price performance over the past 6 months, thereby satisfying the "L" criteria.

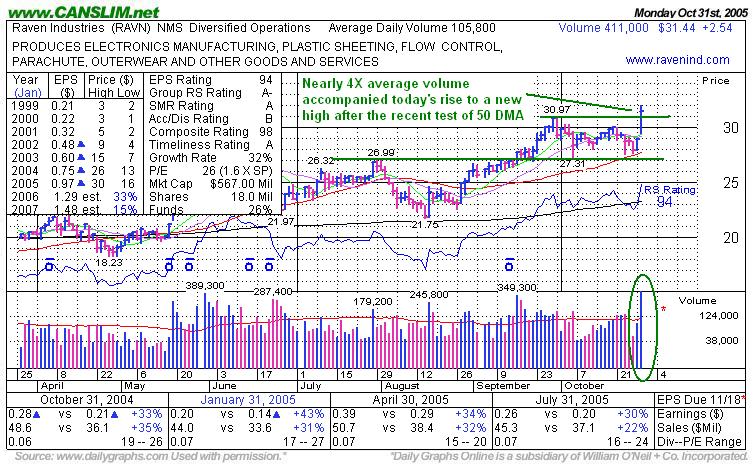

What to Look For and Look Out For: Look for RAVN to build upon its recent breakout, and don't chase the stock more than +5% above its pivot. Any pullback below the $29.50 mark would be a concern, with a violation of its 50-day moving average at $27.71 warranting more serious attention. Another caveat is the lack of liquidity in the issue, as average daily volume of a mere 105,800 shares may discourage involvement by some institutional investors.

Technical Analysis: RAVN’s latest uptrend began in mid-August as the stock reversed course following a two-week losing streak. Its strong quarterly earnings served as the catalyst that would translate into a gain of 43% in the stock price in a month and a half span. As equities fell sharply upon the commencement of the fourth quarter, shares of RAVN pulled back 11% in tepid trade before garnering support at its upward sloping 50-day moving average located at the $27.50 level. On October 31st, RAVN treated investors with a gain of $2.54 to $31.44, exceeding its pivot point of $31.07, as volume exploded to four times its normal pace as a total of 413,210 shares changed hands, thereby triggering a new buy signal. The price/volume action has been stellar with RAVN’s up/down volume ratio a bullish 2.6.

|

|

About :

Frank E. Testa

Frank E. Testa has earned his Chartered Market Technician (CMT) designation and is a Director & Chief Technical Analyst at Ipreo. Frank is a devoted practitioner of the CAN SLIM® methodology and a regular contributor to CANSLIM.net. In addition, Frank is the author of "Candlesticks: Shedding the Light on Pattern Analysis" and developer of the Power Point and Figure Charting Method that was published in "The Journal of Technical Analysis." Frank can be reached at Frank.Testa@ipreo.com.

You can contact Frank E. Testa at frank.testa@cap-bridge.com

|

|

The information

and writings made

avaialable by individuals that successfully passed the CAN SLIM®

Masters Program are their own. Copyright © 1996-2025

Gruneisen Growth Corp. All rights reserved. Protected by the

copyright laws of the United States and Canada and by international

treaties.

|

|

|

|

|